Understanding the World of Cryptocurrency

Cryptocurrency, a digital revolution in the world of finance, has gained significant attention and popularity in recent years. Born out of a desire for decentralized and borderless currency, cryptocurrencies have the potential to reshape how we perceive and use money. In this article, we will explore the fundamentals of cryptocurrency and its impact on the global economy.

Cryptocurrency is a kind of virtual or digital money that is secured by encryption. In contrast to conventional currencies that are issued by central banks and governments, cryptocurrencies function via a decentralized technology known as blockchain. As a public ledger, this blockchain records every transaction in an unchangeable and visible manner.

Bitcoin, created by an anonymous entity known as Satoshi Nakamoto in 2009, is often regarded as the first cryptocurrency. It introduced the concept of a peer-to-peer electronic cash system, allowing individuals to make direct transactions without the need for intermediaries like banks. Since then, thousands of other cryptocurrencies, known as “altcoins,” have emerged, each with its unique features and purposes.

Blockchain Technology

A distributed ledger that records and validates transactions via a network of computers is the foundation of blockchain technology, which powers cryptocurrencies. Transparency, security, and immutability are some of its primary characteristics.. Blockchain technology has applications beyond finance and is being explored in various industries, such as supply chain management, healthcare, and voting systems.

Benefits of Cryptocurrency

- Decentralization: Cryptocurrencies are not controlled by any central authority, reducing the risk of government interference or manipulation.

- Security: Cryptographic techniques make it extremely difficult for unauthorized parties to alter transaction data.

- Global Access: Cryptocurrencies are accessible to anyone with an internet connection, bridging financial inclusion gaps.

- Lower Transaction Costs: Traditional financial institutions often charge fees for international transfers. Cryptocurrency transactions can be more cost-effective.

Challenges and Risks

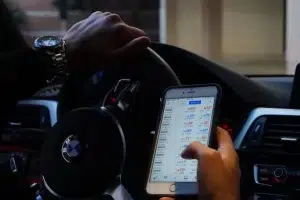

- Volatility: Cryptocurrencies are known for their price fluctuations, which can be both an opportunity and a risk for investors.

- Regulatory Uncertainty: Governments worldwide are still defining the regulatory framework for cryptocurrencies, which can create uncertainty in the market.

- Security Concerns: While blockchain is secure, individuals must take precautions to protect their digital assets from hacking or theft.

The Future of Cryptocurrency

The future of cryptocurrency remains promising. It’s being adopted by some mainstream financial institutions and is increasingly seen as a store of value similar to gold. Additionally, central banks in various countries are exploring the concept of central bank digital currencies (CBDCs) to modernize their monetary systems.

Finally, it should be noted that cryptocurrencies are an innovative invention with the potential to completely change how we conduct financial transactions.. However, it’s important to approach the cryptocurrency market with caution, understanding both its benefits and risks. As the crypto space continues to evolve, it will be intriguing to see how it integrates into the global financial ecosystem.

Remember to conduct thorough research and consult with financial experts before investing in or using cryptocurrencies to ensure a safe and informed journey into this exciting digital frontier